Правильно, никогда не знаешь, когда рынок прочистит всем дымоход по самые гланды, а он это сделает достаточно скоро и 50 превратятся в минус 150.

Поэтому ИМХО лучше спокойно копить и ждать. И обязательно смотреть на графики котировок.

Ну это типичная ошибка тех, кто совершенно не разбирается как работает фондовый рынок.

Специально для тебя от самого Питера Линча.

Since we’re all accustomed to taking action to protect ourselves from

snowstorms and hurricanes, it’s natural that we would try to take action to

protect ourselves from bear markets, even though this is one case in which

being prepared like a Boy Scout does more harm than good. Far more money

has been lost by investors trying to anticipate corrections than has been lost in

all the corrections combined.

One of the worst mistakes you can make is to switch into and out of stocks

or stock mutual funds, hoping to avoid the upcoming correction. It’s also a

mistake to sit on your cash and wait for the upcoming correction before you

invest in stocks. In trying to time the market to sidestep the bears, people

often miss out on the chance to run with the bulls.

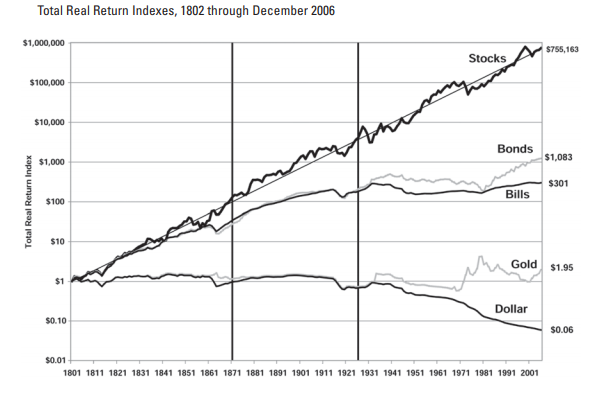

A review of the S&P 500 going back to 1954 shows how expensive it is to

be out of stocks during the short stretches when they make their biggest

jumps. If you kept all your money in stocks throughout these four decades,

your annual return on investment was 11.5 percent. Yet if you were out of

stocks for the forty most profitable months during these forty years, your

return on investment dropped to 2.7 percent.

We explained this earlier, but it is worth repeating. Here’s another telling

statistic. Starting in 1970, if you were unlucky and invested two thousand

dollars at the peak day of the market in each successive year, your annual

return was 8.5 percent. If you timed the market perfectly and invested your

two thousand dollars at the low point in the market in each successive year,

your annual return was 10.1 percent. So the difference between great timing

and lousy timing is 1.6 percent.

Of course, you’d like to be lucky and make that extra 1.1 percent, but

you’ll do just fine with lousy timing, as long as you stay invested in stocks.

Buy shares in good companies and hold on to them through thick and thin.

Выделенное черным говорит само за себя. Если ты придерживался стратегии buy and hold c 1954 до 1994, то твои деньги умножались в 11.5 годовых. Если ты как дурачок пытался to time the market и не был в акциях 40 самых прибыльных месяцев (меньше 4 лет из 40), то у тебя остаются жалкие 2.7%.

Сообщение отредактировал Solitudo: 18 февраля 2020 - 13:45